潍柴动力4Q23Eearningssurged31-71%YoY,aboveexpectation招银国际2024-01-24.pdf

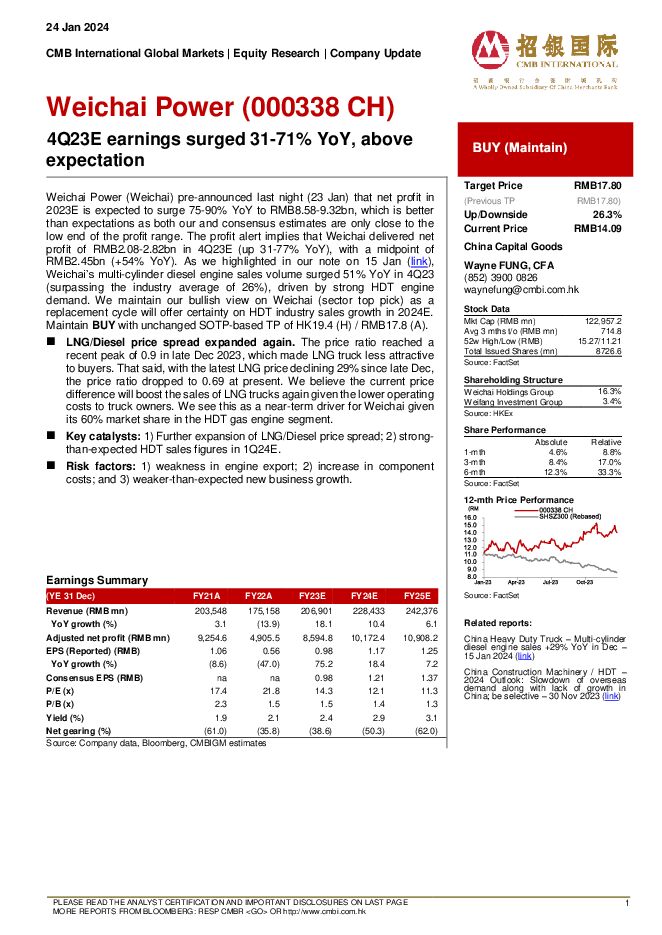

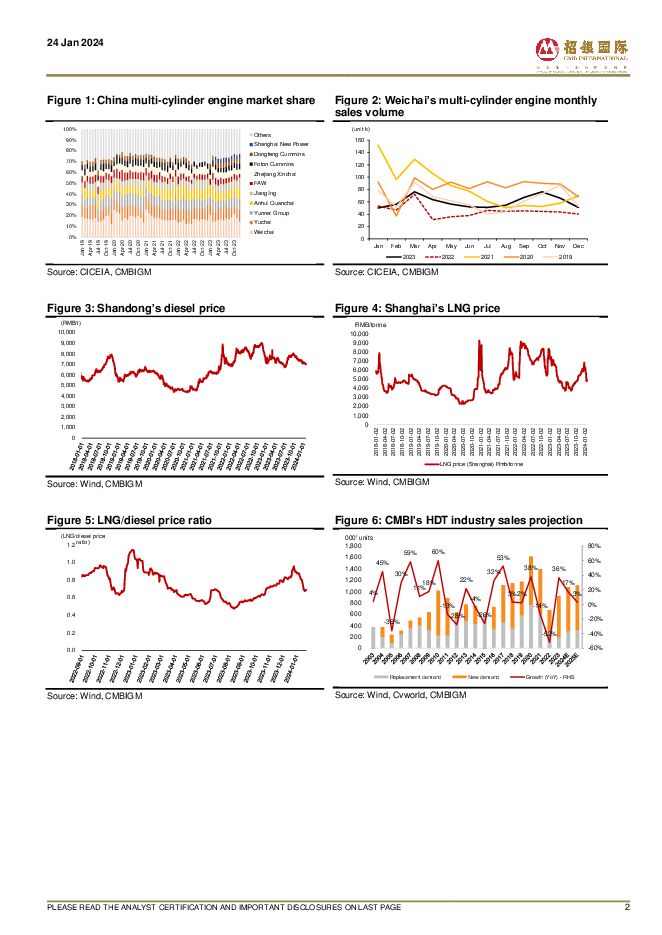

摘要:潍柴动力(000338)Weichai Power (Weichai) pre-announced last night (23 Jan) that net profit in2023E is expected to surge 75-90% YoY to RMB8.58-9.32bn, which is betterthan expectations as both our and consensus estimates are only close to thelow end of the profit range. The profit alert implies that Weichai delivered netprofit of RMB2.08-2.82bn in 4Q23E (up 31-77% YoY), with a midpoint ofRMB2.45bn (+54% YoY). As we highlighted in our note on 15 Jan (link),Weichai’s multi-cylinder diesel engine sales volume surged 51% YoY in 4Q23(surpassing the industry average of 26%), driven by strong HDT enginedemand. We maintain our bullish view on Weichai (sector top pick) as areplacement cycle will offer certainty on HDT industry sales growth in 2024E.Maintain BUY with unchanged SOTP-based TP of HK19.4 (H) / RMB17.8 (A).LNG/Diesel price spread expanded again. The price ratio reached arecent peak of 0.9 in late Dec 2023, which made LNG truck less attractiveto buyers. That said, with the latest LNG price declining 29% since late Dec,the price ratio dropped to 0.69 at present. We believe the current pricedifference will boost the sales of LNG trucks again given the lower operatingcosts to truck owners. We see this as a near-term driver for Weichai givenits 60% market share in the HDT gas engine segment.Key catalysts: 1) Further expansion of LNG/Diesel price spread; 2) strongthan-expected HDT sales figures in 1Q24E.Risk factors: 1) weakness in engine export; 2) increase in componentcosts; and 3) weaker-than-expected new business growth.

免责声明: 1.本站部分作品是由网友自主投稿和发布、编辑整理上传,对此类作品本站仅提供交流平台,不为其版权负责。 2.如发布机构认为违背了您的权益,请与我们联系,我们将对相关资料予以删除。 3.资源付费,仅为我们搜集整理和运营维护费用,感谢您的支持!

合集服务: 单个细分行业的合集获取请联系行研君:hanyanjun830

-

泰格医药 Meaningful demand recovery in 1Q24 招银国际 2024-04-29(6页) 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

1.13 MB共6页中文简体

1天前21518积分

-

三一重工2023netprofitamiss1Q24stillweakStayonthesidelines招银国际2024-04-29 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

1.19 MB共页中文简体

1天前7618积分

-

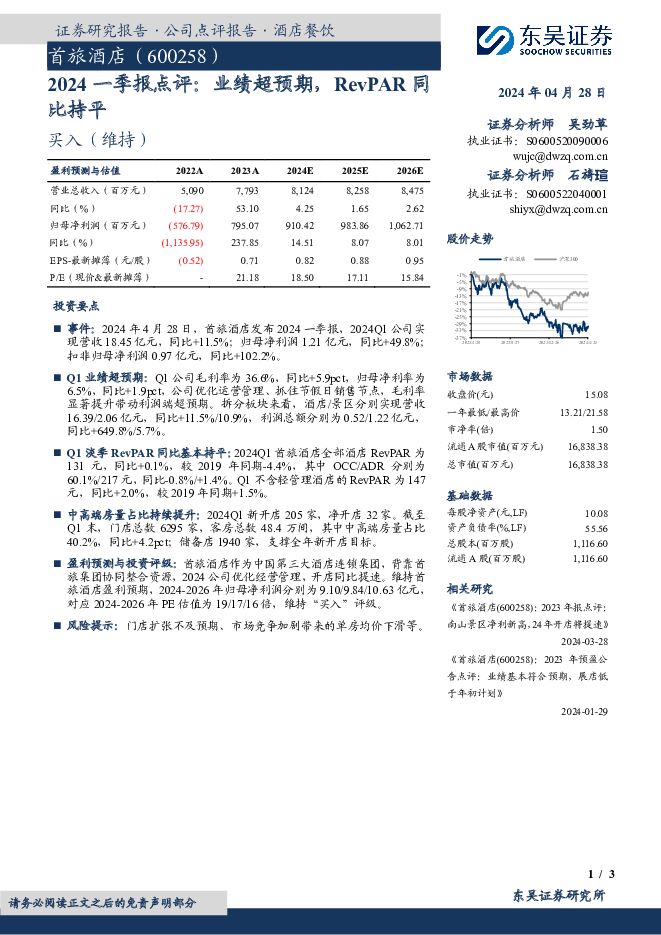

首旅酒店 2024一季报点评:业绩超预期,RevPAR同比持平 东吴证券 2024-04-29(3页) 附下载

首旅酒店(600258)投资要点事件:2024年4月28日,首旅酒店发布2024一季报,2024Q1...

746.02 KB共3页中文简体

1天前99718积分

-

医疗服务行业专题报告:HCA Healthcare:强者只会更强大 华福证券 2024-04-26(20页) 附下载

投资要点HCA Healthcare是全球最大的连锁医疗集团。公司集医、护、保、教、管全产业链为一体...

2.03 MB共20页中文简体

2天前46220积分

-

彤程新材 新产品、新客户持续突破,ArF光刻胶二季度有望起量 中泰证券 2024-04-26(3页) 附下载

彤程新材(603650)投资要点事件:公司发布2023年年度报告,实现营业收入29.44亿元,yoy...

552.92 KB共3页中文简体

2天前62318积分

-

立讯精密FY23in-linewithbetter-than-feared1H24earningsguidanceSolidoutlookahead招银国际2024-04-26 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

1.36 MB共页中文简体

2天前95118积分

-

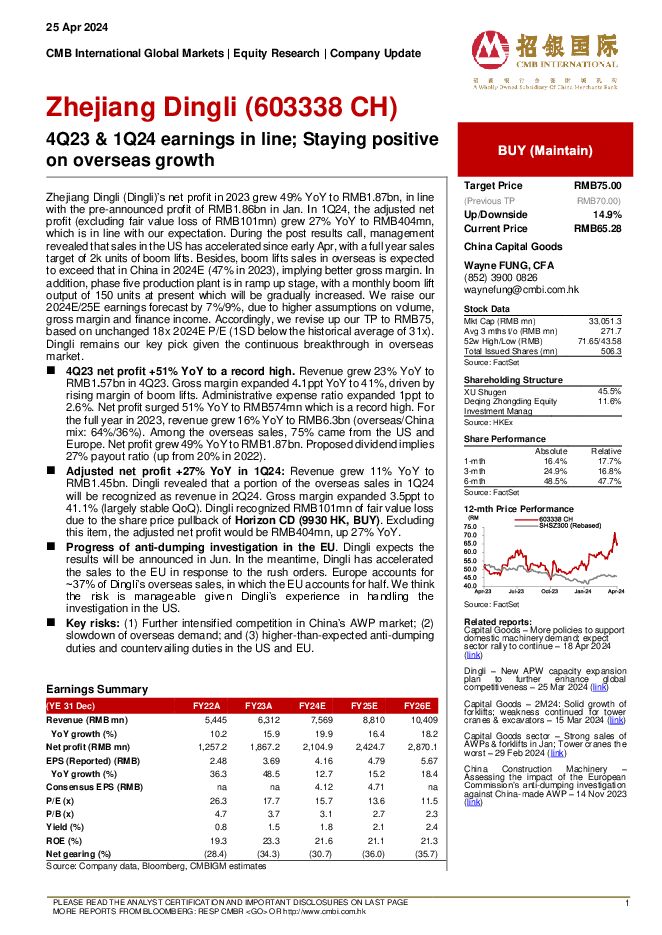

浙江鼎力4Q23&1Q24earningsinlineStayingpositiveonoverseasgrowth招银国际2024-04-25 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

1.23 MB共7页中文简体

5天前12018积分

-

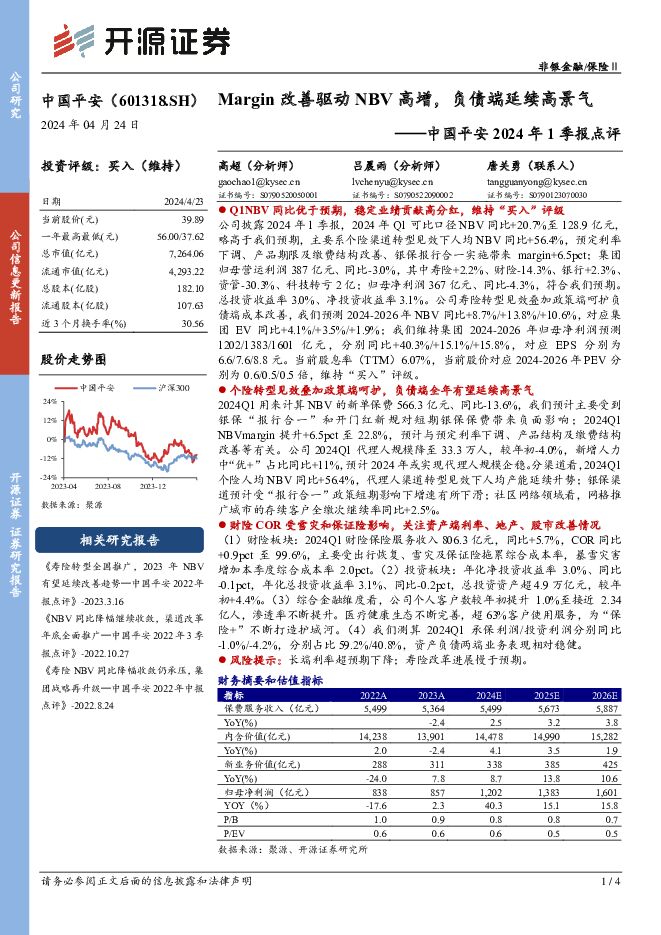

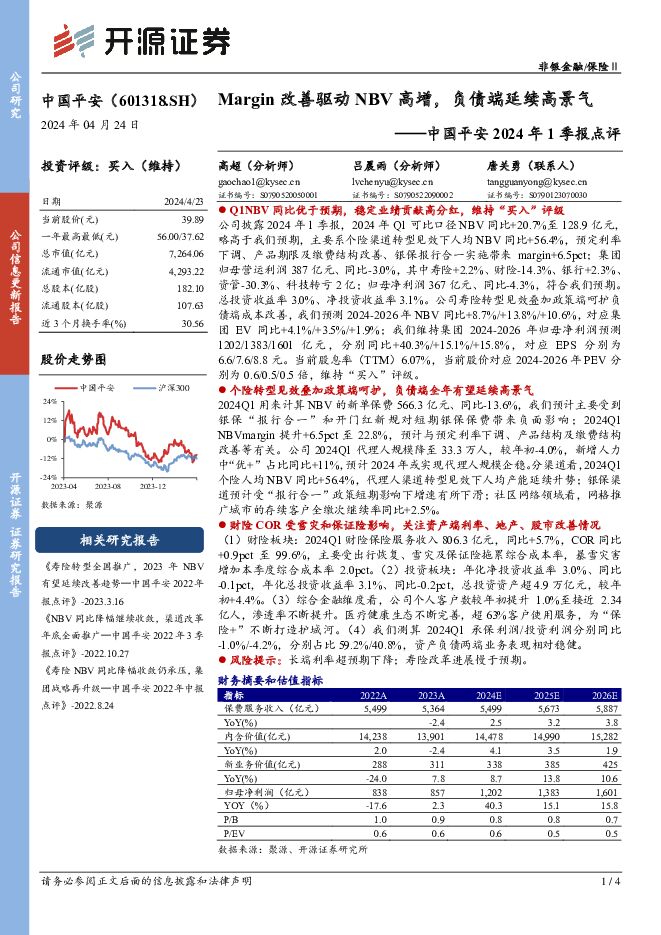

中国平安 中国平安2024年1季报点评:Margin改善驱动NBV高增,负债端延续高景气 开源证券 2024-04-24(4页) 附下载

中国平安(601318)Q1NBV同比优于预期,稳定业绩贡献高分红,维持“买入”评级公司披露2024...

809.22 KB共4页中文简体

6天前97718积分

-

中国平安 中国平安2024年1季报点评:Margin改善驱动NBV高增,负债端延续高景气 开源证券 2024-04-24(4页) 附下载

中国平安(601318)Q1NBV同比优于预期,稳定业绩贡献高分红,维持“买入”评级公司披露2024...

809.22 KB共4页中文简体

6天前70018积分

-

恒立液压4Q23&1Q24earningsnotexcitingbutmorepositivedriverstocome招银国际2024-04-24 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

1.11 MB共7页中文简体

6天前81618积分

-

恒立液压4Q23&1Q24earningsnotexcitingbutmorepositivedriverstocome招银国际2024-04-24 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

1.11 MB共7页中文简体

6天前6218积分

-

中际旭创 1Q24 results set stage for accelerated growth in 2024 招银国际 2024-04-24(5页) 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

896.47 KB共5页中文简体

6天前20918积分

-

中际旭创 1Q24 results set stage for accelerated growth in 2024 招银国际 2024-04-24(5页) 附下载

富强、民主、文明、和谐、自由、平等、公正、法治、爱国、敬业、诚信、友善

896.47 KB共5页中文简体

6天前40218积分

-

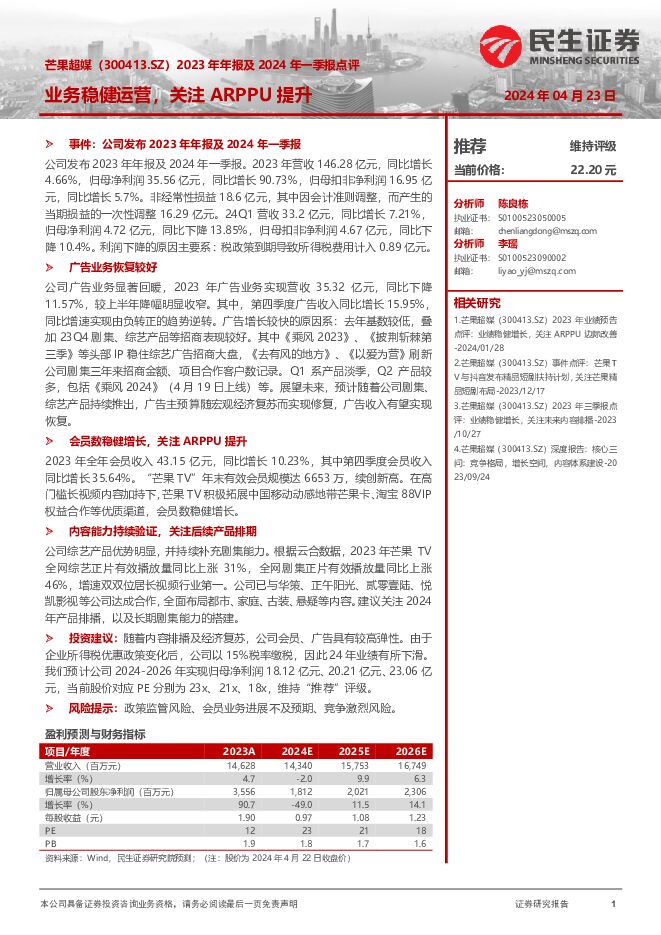

芒果超媒 2023年年报及2024年一季报点评:业务稳健运营,关注ARPPU提升 民生证券 2024-04-23(3页) 附下载

芒果超媒(300413)事件:公司发布2023年年报及2024年一季报公司发布2023年年报及202...

685.08 KB共3页中文简体

7天前29418积分

-

Q1’24全球AMOLED手机面板出货量同比增长45.0%!中国厂商出货份额首次超越五成 CINNO Research 2024-04-22(18页) 附下载

根据CINNO Research统计数据显示,2024年第一季度全球市场AMOLED智能手机面板出货...

365.44 KB共18页中文简体

1周前35220积分

-

通信行业专题研究:Marvell AI day,算力需求推动光互联加速迭代 国联证券 2024-04-21(11页) 附下载

MarvellAI相关业务有望快速增长Marvell于近日举办AIday投资者交流会,介绍了公司在A...

1.04 MB共11页中文简体

1周前46720积分

-

美的集团 拟收购Arbonia暖通业务,楼宇出海再落一子 国联证券 2024-04-19(3页) 附下载

美的集团(000333)事件:美的集团拟通过子公司以约7.6亿欧元对价(约58.8亿人民币)100%...

400.54 KB共3页中文简体

1周前37218积分

-

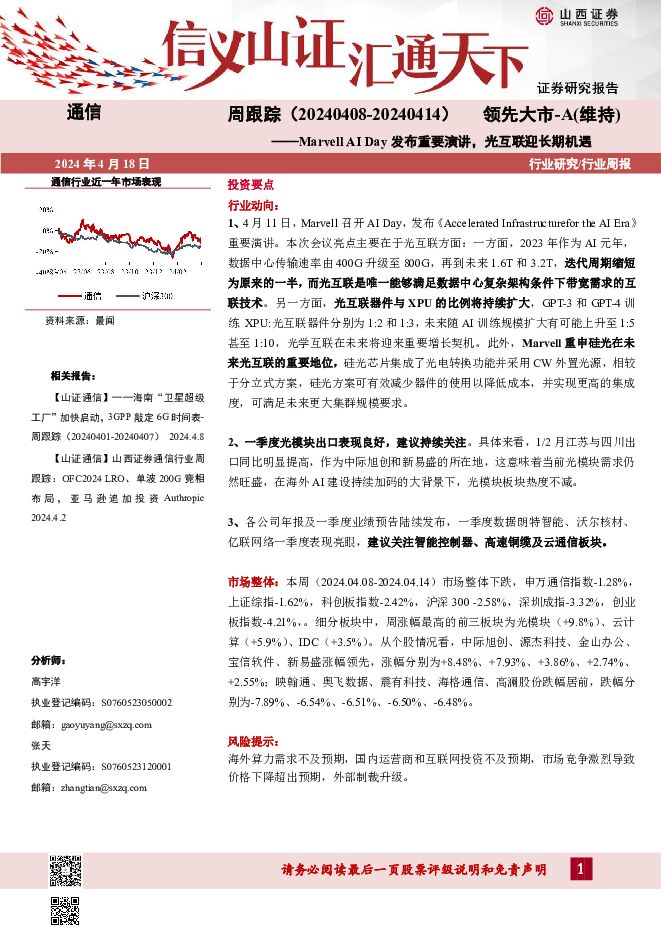

通信周跟踪:Marvell AI Day发布重要演讲,光互联迎长期机遇 山西证券 2024-04-18(17页) 附下载

投资要点行业动向:1、4月11日,Marvell召开AIDay,发布《AcceleratedInfr...

1.5 MB共17页中文简体

1周前39420积分

-

通信行业点评:Marvell AI Day释放增量信息,持续坚定看好光模块 天风证券 2024-04-17(8页) 附下载

for the AI Era”会议,公司在会上分享了经营业务、算力网络、光互联等相关信息。公司AI加...

1019.15 KB共8页中文简体

1周前82720积分

-

美国经济:经济仍具韧性 招银国际 2024-04-17(5页) 附下载

美国3月零售环比增长0.7%,过去两月增速大幅上修,显示商品消费仍具韧性。分品类来看,汽油、日用品、...

731.32 KB共5页中文简体

1周前89915积分