工商银行Highfundamentalstabilityascorestrength农银国际证券2022-05-17.pdf

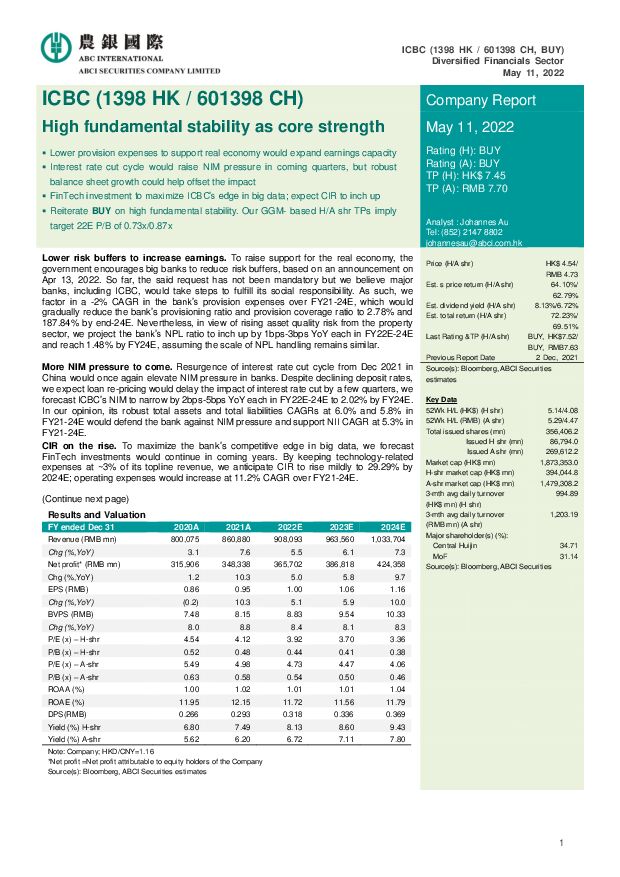

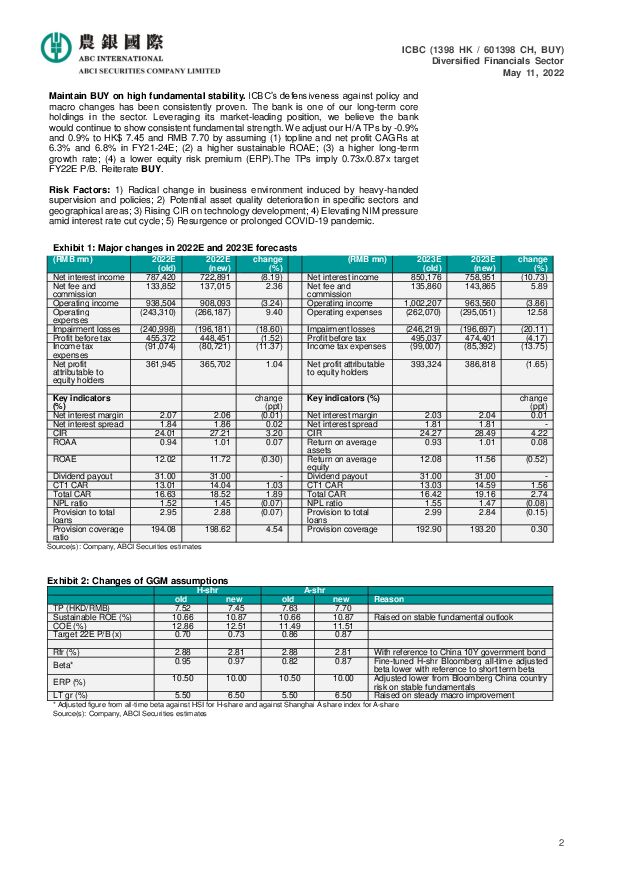

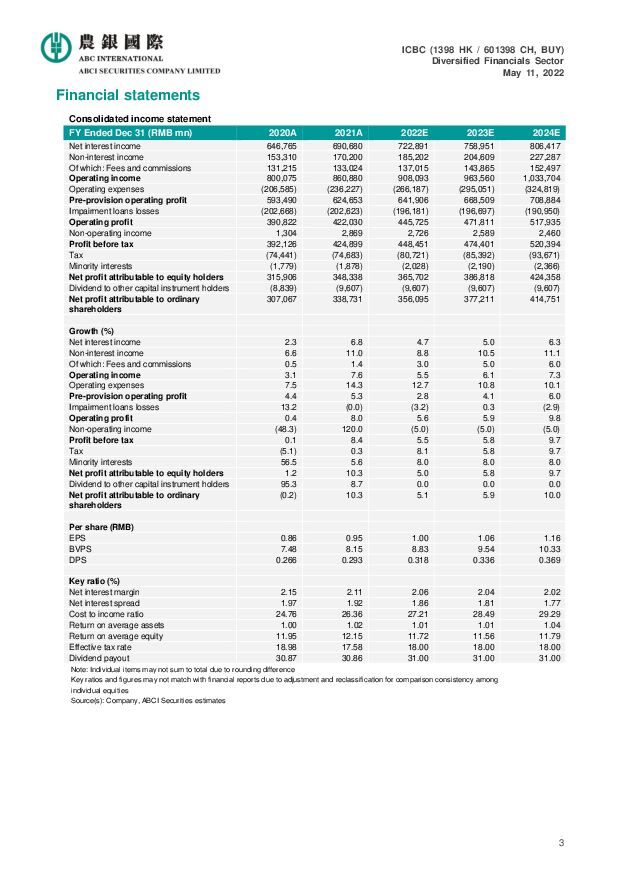

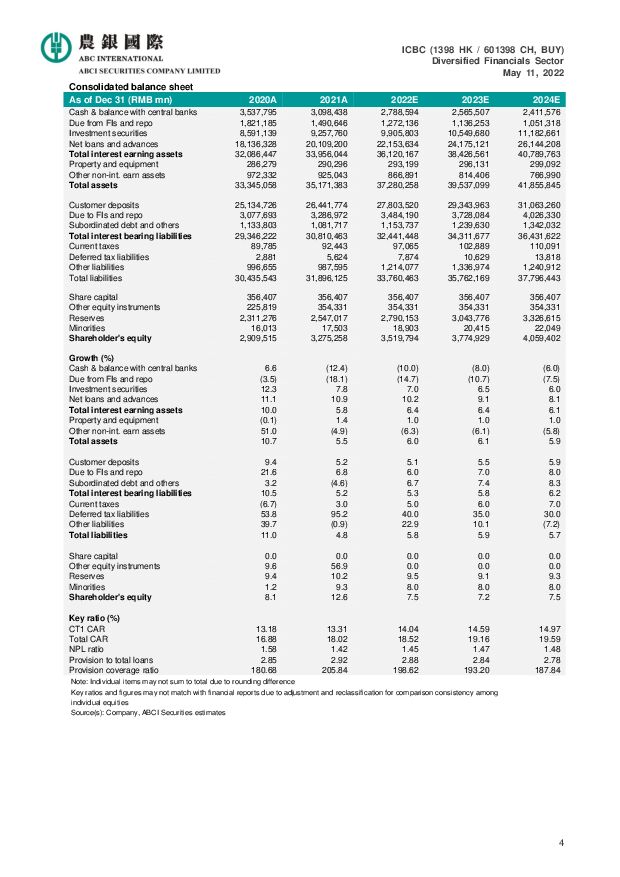

摘要:工商银行(601398)Lower provision expenses to support real economy would expand earnings capacityInterest rate cut cycle would raise NIM pressure in coming quarters, but robustbalance sheet growth could help offset the impactFinTech investment to maximize ICBC’s edge in big data; expect CIR to inch upReiterate BUY on high fundamental stability. Our GGM- based H/A shr TPs implytarget 22E P/B of 0.73x/0.87xLower risk buffers to increase earnings. To raise support for the real economy, thegovernment encourages big banks to reduce risk buffers, based on an announcement onApr 13, 2022. So far, the said request has not been mandatory but we believe majorbanks, including ICBC, would take steps to fulfill its social responsibility. As such, wefactor in a -2% CAGR in the bank’s provision expenses over FY21-24E, which wouldgradually reduce the bank’s provisioning ratio and provision coverage ratio to 2.78% and187.84% by end-24E. Nevertheless, in view of rising asset quality risk from the propertysector, we project the bank’s NPL ratio to inch up by 1bps-3bps YoY each in FY22E-24Eand reach 1.48% by FY24E, assuming the scale of NPL handling remains similar.More NIM pressure to come. Resurgence of interest rate cut cycle from Dec 2021 inChina would once again elevate NIM pressure in banks. Despite declining deposit rates,we expect loan re-pricing would delay the impact of interest rate cut by a few quarters, weforecast ICBC’s NIM to narrow by 2bps-5bps YoY each in FY22E-24E to 2.02% by FY24E.In our opinion, its robust total assets and total liabilities CAGRs at 6.0% and 5.8% inFY21-24E would defend the bank against NIM pressure and support NII CAGR at 5.3% inFY21-24E.CIR on the rise. To maximize the bank’s competitive edge in big data, we forecastFinTech investments would continue in coming years. By keeping technology-relatedexpenses at ~3% of its topline revenue, we anticipate CIR to rise mildly to 29.29% by2024E; operating expenses would increase at 11.2% CAGR over FY21-24E.Maintain BUY on high fundamental stability. ICBC’s defensiveness against policy andmacro changes has been consistently proven. The bank is one of our long-term coreholdings in the sector. Leveraging its market-leading position, we believe the bankwould continue to show consistent fundamental strength. We adjust our H/A TPs by -0.9%and 0.9% to HK$ 7.45 and RMB 7.70 by assuming (1) topline and net profit CAGRs at6.3% and 6.8% in FY21-24E; (2) a higher sustainable ROAE; (3) a higher long-termgrowth rate; (4) a lower equity risk premium (ERP).The TPs imply 0.73x/0.87x targetFY22E P/B. Reiterate BUY.Risk Factors: 1) Radical change in business environment induced by heavy-handedsupervision and policies; 2) Potential asset quality deterioration in specific sectors andgeographical areas; 3) Rising CIR on technology development; 4) Elevating NIM pressureamid interest rate cut cycle; 5) Resurgence or prolonged COVID-19 pandemic.

免责声明: 1.本站部分作品是由网友自主投稿和发布、编辑整理上传,对此类作品本站仅提供交流平台,不为其版权负责。 2.如发布机构认为违背了您的权益,请与我们联系,我们将对相关资料予以删除。 3.资源付费,仅为我们搜集整理和运营维护费用,感谢您的支持!

合集服务: 单个细分行业的合集获取请联系行研君:hanyanjun830

-

银行业跟踪:优化国有金融资本定位,引导国有行信贷均衡投放 东兴证券 2024-04-29(12页) 附下载

周观点上周财政部副部长廖岷在全人常会议上作《国务院关于金融企业国有资产管理情况专项报告审议意见的研究...

1.19 MB共12页中文简体

5天前92520积分

-

非银行业周报:打造金融“国家队”,看好国央企金融价值重估 华福证券 2024-04-29(9页) 附下载

本周观点:本周各险企陆续披露一季报,从平安、太保、国寿来看,净利润表现扭转前期市场担忧,NBV普遍延...

995.06 KB共9页中文简体

5天前24820积分

-

非银行金融行业跟踪:金融行业做大做强预期不断提升,建议继续关注并购重组主线 东兴证券 2024-04-29(8页) 附下载

证券:本周市场日均成交额环比减少约900亿至0.85万亿;两融余额(4月25日,周四)微降至1.52...

808 KB共8页中文简体

5天前61620积分

-

长沙银行 息差韧性凸显,资产质量保持稳健 平安证券 2024-04-29(5页) 附下载

长沙银行(601577)事项:长沙银行发布2023年年报及2024年一季报,公司23年、24Q1分别...

1.05 MB共5页中文简体

5天前64918积分

-

苏州银行 非息拉动营收回暖,信贷扩张保持积极 平安证券 2024-04-29(5页) 附下载

苏州银行(002966)事项:苏州银行发布2023年年报及2024年一季报,公司23年、24Q1分别...

1.37 MB共5页中文简体

5天前83618积分

-

江苏银行 详解江苏银行2023年报&2024一季报:稳步扩表;Q1营收利润两位数增长;分红率维持30% 中泰证券 2024-04-29(18页) 附下载

江苏银行(600919)投资要点财报综述:1、23年业绩增速下降,24Q1营收利润维持两位数增速。1...

954.8 KB共18页中文简体

5天前60818积分

-

银行防资金空转视角的观察:存款成本高企背后 开源证券 2024-04-26(7页) 附下载

现象:银行存款定期化,负债成本不降反升近年部分银行对公活期存款成本率逐年上升、3M和6M存款利率亦明...

1.15 MB共7页中文简体

6天前66520积分

-

非银行金融行业周报:公募费改全面落地,高质量发展渐行渐稳 山西证券 2024-04-26(11页) 附下载

投资要点公募费率改革措施全面落地。4月19日,证监会制定发布《公开募集证券投资基金证券交易费用管理规...

1001.99 KB共11页中文简体

6天前75420积分

-

长沙银行 长沙银行2023年报及2024Q1季报点评:营收增速稳定,扩表动能强劲 开源证券 2024-04-28(6页) 附下载

长沙银行(601577)营收维持较高增长,盈利能力稳中向好长沙银行2023年全年分别实现营收248....

1.13 MB共6页中文简体

6天前24418积分

-

兴业银行 2024年一季报点评:业绩增速触底回升,营收同比+4.2% 民生证券 2024-04-26(6页) 附下载

兴业银行(601166)事件:4月25日,兴业银行发布2024年一季报。24Q1实现营收578亿元,...

779.99 KB共6页中文简体

6天前24318积分

-

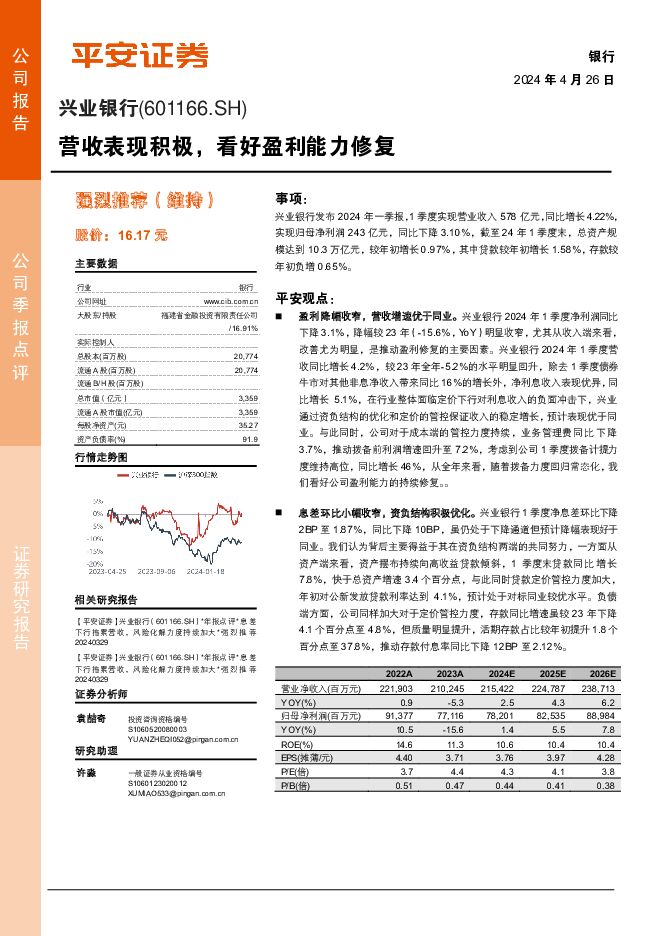

兴业银行 营收表现积极,看好盈利能力修复 平安证券 2024-04-26(5页) 附下载

兴业银行(601166)事项:兴业银行发布2024年一季报,1季度实现营业收入578亿元,同比增长4...

1.07 MB共5页中文简体

6天前60818积分

-

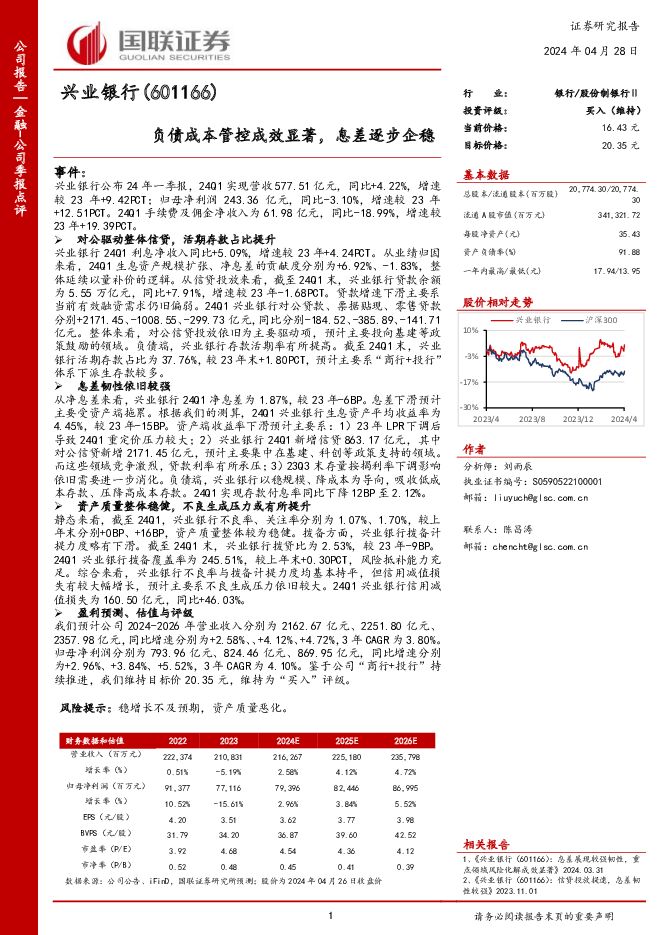

兴业银行 负债成本管控成效显著,息差逐步企稳 国联证券 2024-04-28(3页) 附下载

兴业银行(601166)事件:兴业银行公布24年一季报,24Q1实现营收577.51亿元,同比+4....

329.43 KB共3页中文简体

6天前14918积分

-

苏州银行 苏州银行2023年报及2024Q1季报点评:营收增速回暖,资产质量保持稳健 开源证券 2024-04-28(6页) 附下载

苏州银行(002966)2024Q1单季营收增速止跌回升,归母净利润保持较高增长苏州银行2023年实...

993.55 KB共6页中文简体

6天前11518积分

-

上海银行 营收降幅收窄,分红抬升关注股息配置价值 平安证券 2024-04-26(5页) 附下载

上海银行(601229)事项:上海银行发布2023年年报及2024年一季报,23年和24Q1分别实现...

1.01 MB共5页中文简体

6天前39418积分

-

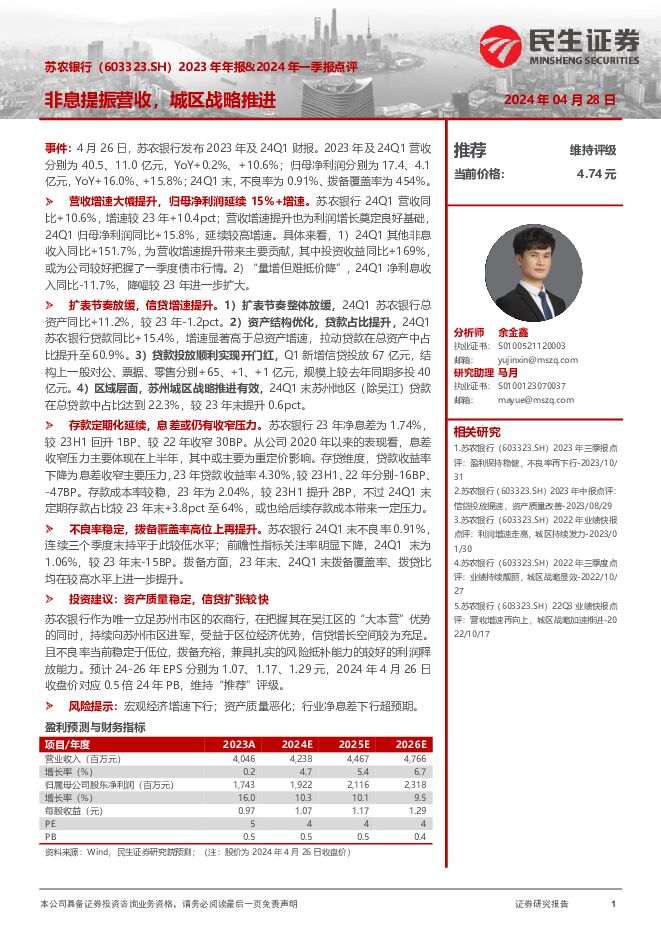

苏农银行 2023年年报&2024年一季报点评:非息提振营收,城区战略推进 民生证券 2024-04-28(6页) 附下载

苏农银行(603323)事件:4月26日,苏农银行发布2023年及24Q1财报。2023年及24Q1...

778.68 KB共6页中文简体

6天前37618积分

-

苏州银行 2023年年报&2024年一季报点评:信贷投放积极,营收增速提升 民生证券 2024-04-28(7页) 附下载

苏州银行(002966)事件:4月26日,苏州银行发布2023年及24Q1财报。2023年及24Q1...

778.92 KB共7页中文简体

6天前78518积分

-

齐鲁银行 齐鲁银行2023年报&2024一季报点评:ROE表现优异,核心资本进一步夯实 信达证券 2024-04-27(6页) 附下载

齐鲁银行(601665)事件:4月26日晚,齐鲁银行发布2023年年报&2024年一季报:2023年...

612.61 KB共6页中文简体

6天前19718积分

-

南京银行 2023年年报&2024年一季报点评:业绩增速触底回升,不良、关注率双降 民生证券 2024-04-28(7页) 附下载

南京银行(601009)事件:4月26日,南京银行发布2023年及24Q1财报。2023、24Q1营...

982.7 KB共7页中文简体

6天前70718积分

-

江苏银行 非息带动营收回暖,资产质量保持稳定 平安证券 2024-04-26(5页) 附下载

江苏银行(600919)事项:江苏银行发布2023年年报及2024年一季报,公司23年、24Q1分别...

1.04 MB共5页中文简体

6天前33218积分

-

江苏银行 2023年年报&2024年一季报点评:营收增速回升,资产质量稳定 民生证券 2024-04-26(6页) 附下载

江苏银行(600919)事件:4月25日,江苏银行发布2023年及24Q1财报。2023、24Q1营...

762.55 KB共6页中文简体

6天前50918积分